There has been a lot of corporate insider trading lately.

Key executives are selling off large amounts of their company stocks. This obviously has raised questions about their confidence in the ongoing economic story.

These are the people who know their companies and [supposedly] markets best. But, they are selling their shares at a higher-than-normal pace.

This begs the question: Are they expecting a market downturn due to a collapse in the promise of falling interest rates and higher inflation?

As an investor, would you sell your asset if you expected it to appreciate at its normal rate in the future?

Some examples:

- Jamie Dimon, CEO of JP Morgan, has sold $180 million worth of shares this year.

- Sundar Pichai of Alphabet Inc. (Google) has liquidated over 200,000 shares in the last year, with no purchases reported.

- Jeff Bezos has parted with $8.5 billion in Amazon stock.

- Mark Zuckerberg has offloaded 1.4 million shares of Meta, totaling $638 million, since February.

- The Walton family has reduced their Walmart holdings by $1 billion.

These sales have not gone unnoticed. They happened as the S&P 500 index reached record highs. This was a time when the public still believed inflation was squashed and lower rates were coming.

The Federal Reserve's recent policies on interest rates and money printing have made it hard to trust traditional signals. We've seen inflated asset prices that are disconnected from the economy.

Investors entered the year expecting up to six interest rate cuts—a welcomed outlook— but those expectations are dimming.

Despite claims of falling inflation, the reality seems to differ.

Is the market beginning to acknowledge these discrepancies?

Interestingly, despite high-interest rates and a strong dollar—conditions that typically lead to a drop in gold prices—we are witnessing an increase to record highs.

I believe this unusual trend means that gold, and maybe global investors, sense hidden risks. The risks are not in the common story or you see on the news and on most news publications.

Geopolitical risks are also at some of their highest levels in decades.

Here is a text I received this week from an investor in his 60's:

It's crucial to stay informed and cautious right now as we approach the upcoming election and interest rate decisions.

Yes, the insider sales mentioned above were pre-planned and declared. But, their high volume and pace—50 times higher than insider buying—suggest something else may be at play.

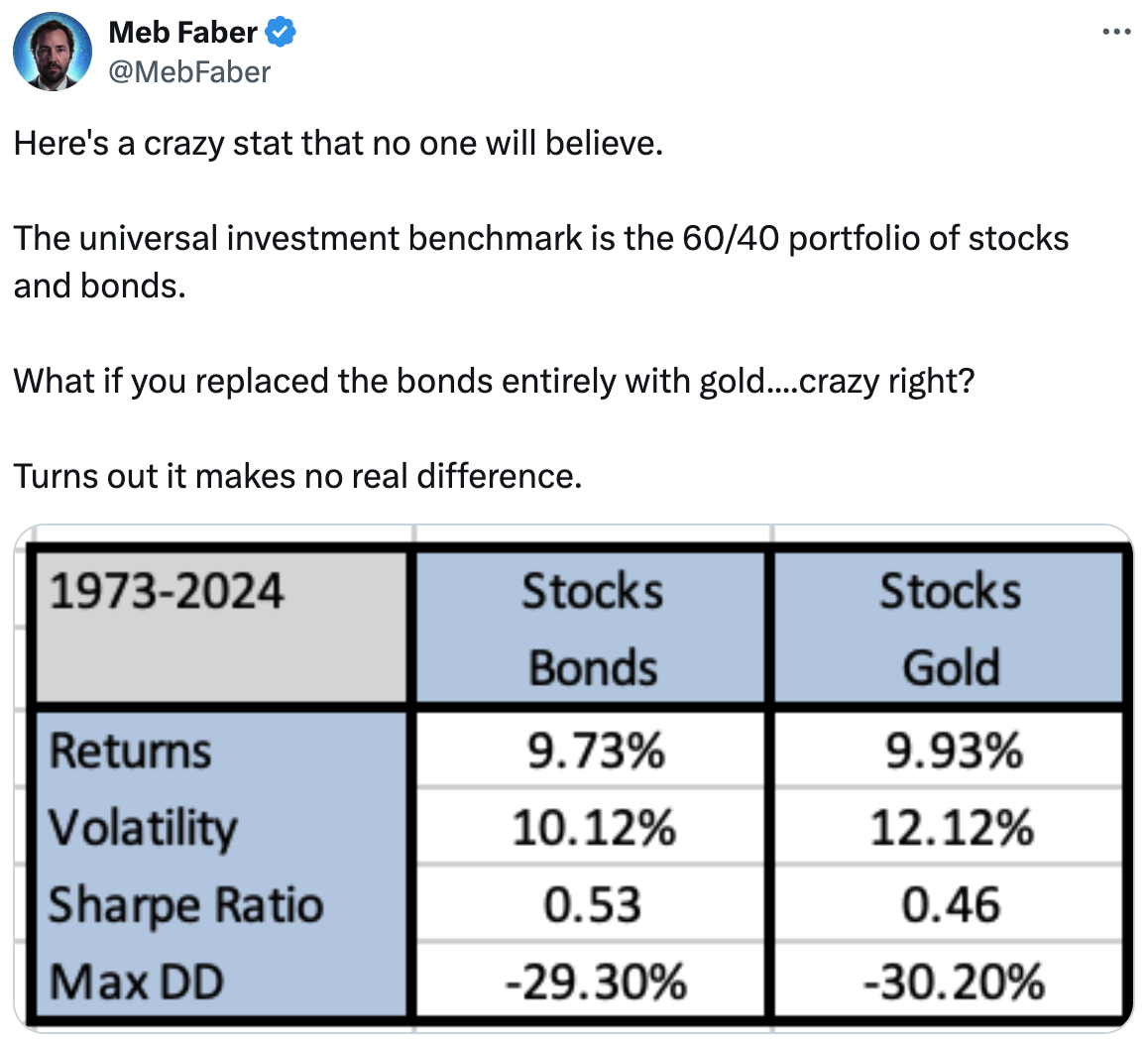

Lastly, here's a stat you likely won't see in the traditional financial circles. 40% of a portfolio in gold sounds nice. And gold comes with no counterparty risk!

As always, if you'd like to discuss any of these topics further, I'm always available. Feel free to give me a call anytime.

Tags:

Apr 26, 2024 12:00:00 AM

Comments