The U.S. Debt has surpassed $35 Trillion

I often get asked, "Why should I invest in gold?"

My response is always the same, "Have you seen the U.S. debt chart?"

We're past the point of managing the debt. The parabolic amount, which is now greater than $35 trillion, is the #1 reason why I believe everyone should own gold in their portfolio.

The cost of servicing this debt is more then $1 trillion per year. That's $2.4 billion PER DAY.

As long as the debt mountain keeps increasing, the money machine will continue to debase the currency that we find ourselves using every day.

As Ray Dalio once said, "If you're not aggressive you're not going to make money, and if you're not defensive you're not going to keep money".

Gold is insurance and the premier defensive asset that belongs in everyones portfolio.

The price of gold has tracked pretty closely with the ballooning debt over the last 50 years.

And by the way, none of this is new. Governments have been overspending for centuries which is why fiat currencies have a 100% fail rate.

I don't expect the spending to stop anytime soon. Do you?

The job market is flashing warning signals

I said at the beginning of last month that unemployment is about to become a major factor in policy decisions pretty quickly.

That trend doesn't seem to be slowing down.

The Fed's next move on rate cuts is all about the job market, and the job market is flashing some pretty serious warning signs.

Employers added 114,000 jobs in July (that's not a lot), as reported by the U.S. Labor Department, with the unemployment rate climbing to 4.3%. The expectation for jobs was 176,000.

This was an unexpected, sharp drop in the labor market to most. It had been somewhat resilient during the Fed's rate hikes over the last 2 years.

Lyn Alden describes the latest unemployment data the best:

Yep, dumpster fire. 🤣

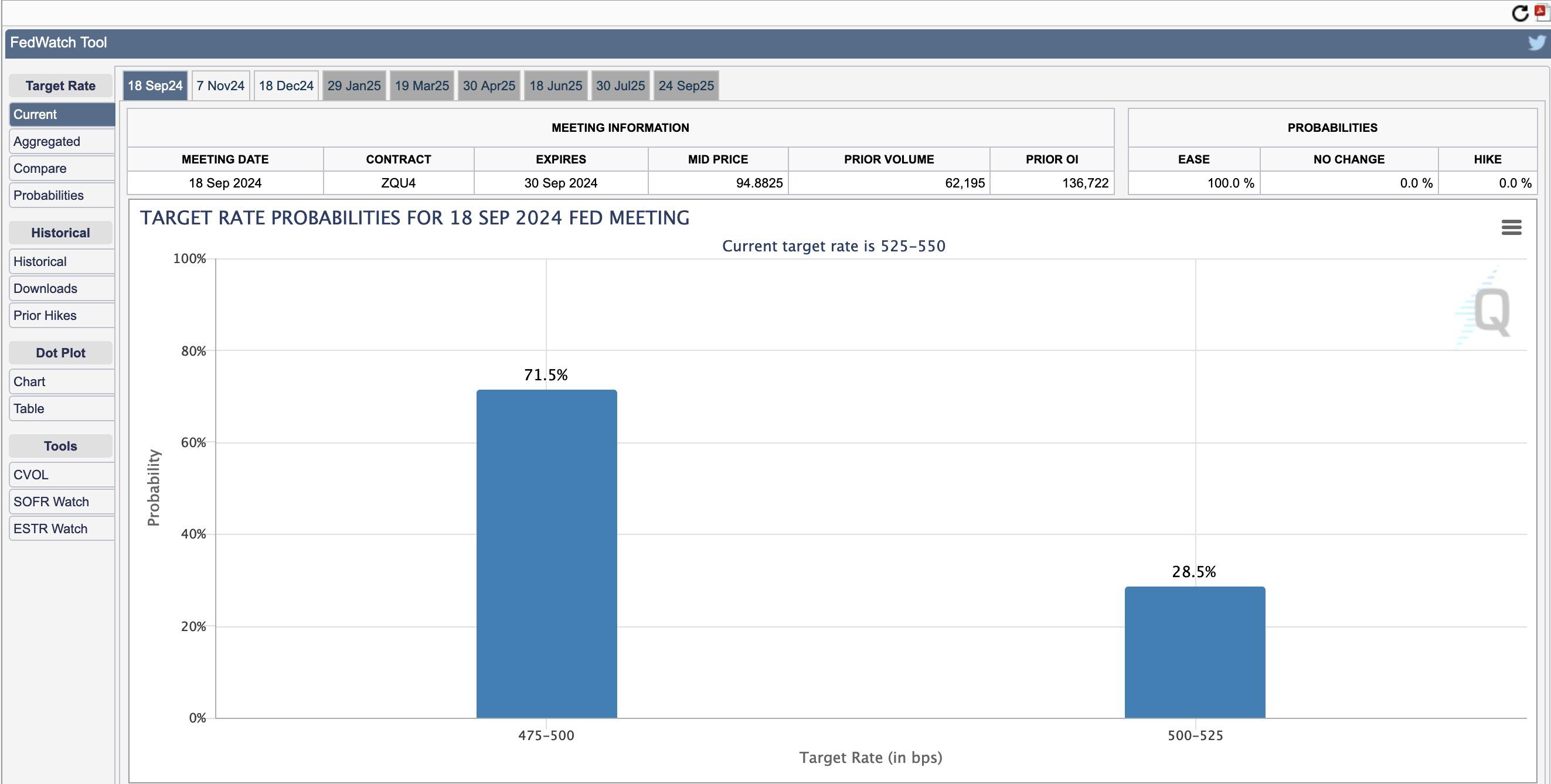

And now with these numbers filtering out into the market, bets on September rate cuts are changing quickly. Odds of a 50 basis point cut in September are priced at 71.5% right now.

What do lower rates mean for precious metals?

When interest rates drop, history tells us it’s like a big green light for gold and silver prices to surge.

Lower rates mean bonds become less attractive due to their falling yields so smart investors turn to other safe and proven assets, like gold.

Lower rates also indicate that something is happening in the economy, usually negatively.

This also drives people to safe-haven assets like gold and silver. They seek to protect their wealth and hedge against rising inflation. As we said last week, silver has returned +332% in the last three Fed rate-cutting cycles on average.

Sure, there are a ton of factors that can impact prices in the short-term but this one is simple to understand. Gold and silver are long-term preservers of wealth and price appreciation is a secondary benefit (in my opinion). But who doesn't like a shot of adrenaline to an asset they hold in hand?

Lastly, George Gammon sounds the alarm on one powerful indicator that is signaling an incoming recession. This is the best video I watched all week with meaningful insights into banking stress and a possible incoming recession.

Tags:

Aug 2, 2024 12:00:00 AM

Comments