Top things to know:

- Massive gold and silver publication released

- Silver hits 12-year high

- Russia + China's joint statement criticizing the US

2024's In Gold We Trust report published

The In Gold We Trust report is the world's largest annual research project on gold (and silver).

It was released last Friday and I was able to sit down with Ted Butler who did the research and wrote the entire section on silver. You can watch our conversation by clicking the image above.

Here are some highlights:

- Silver on track for 4th consecutive supply deficit

- Silver has averaged 332% return over the last 3 rate cutting cycles

- A return to historical median of gold/silver ratio puts silver at $80/oz

I can't emphasize enough how incredible this publication is. It's over 400 pages long (but also comes with a compact version).

It doesn't blindly pump the importance of precious metals and their relevant markets. It examines the data and works through both the bull and bear cases for each.

I've got a link to the report below. I highly recommend looking through it. The Silver chapter begins on page 318.

In summary I'll say, the future is bright for gold and silver.

Full In Gold We Trust report linked here.

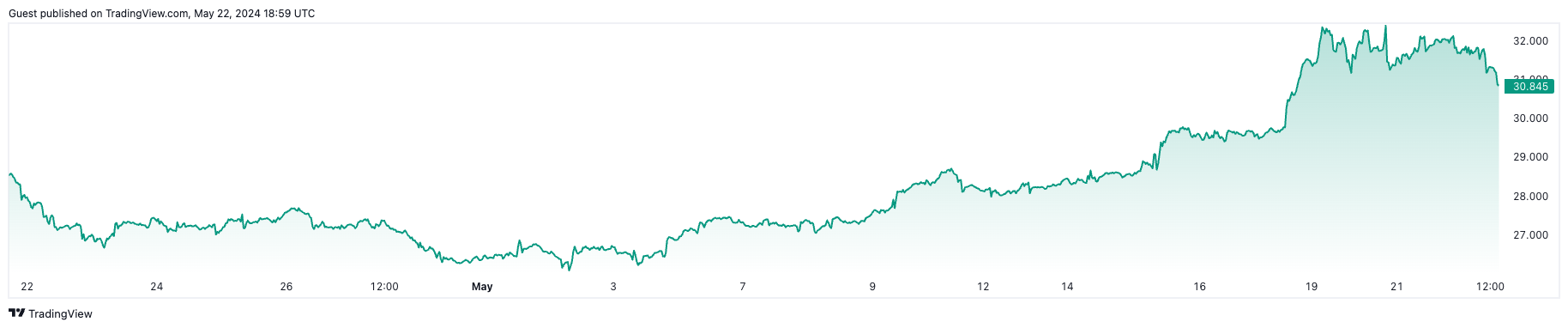

Silver hit's 12-year high

One of the things Ted and I discuss is silver's "slingshot effect".

In short, silver prices tend to lag behind gold but when they finally catch up, they do so with a vengeance.

Gold hit a fresh all-time high last week and silver touched it's highest price in 12 years at $32.50.

Silver has outperformed gold in 3 of the last 7 gold bull markets and 6 out of the last 7 silver bull markets.

Silver is also the only metal to have not surpassed it's all-time high from 1980. Gold, copper, lead, nickel, zinc, tin, iron, platinum, palladium, and rhodium have all managed to do so since then.

Several analyst have pointed out that even Costco seems to be preparing for what's to come. They've made headlines lately with the amount of gold they're selling but they are also stocking their shelves with silver eagles.

The fundamentals for silver continue to strengthen when considering supply/demand imbalances, global debt, surges in solar panel use, and central bank gold buying.

Russia and China issue joint statement criticizing USA

Over the weekend, Russia and China released a joint statement emphasizing their "no-limits" partnership and pledging to deepen their strategic cooperation.

Vince Lanci called the statement a "divorce agreement from the West".

Here are the key points you need to know about the statement:

- Each country affirmed each other's core interests, including Taiwan for China and Ukraine for Russia.

- They openly criticized the United States for having a "Cold War mentality", and accused our government of fueling conflicts and destabilizing the world order.

- They promoted a "democratic multipolar world order" through platforms like BRICS

It's no secret now that countries are actively working to diversify their risk away from the United States. After the US cutoff Russia's access to tons of western financial systems, the two countries have increased trade between one another which has helped limit the impact of those sanctions.

China has since upped it's gold reserves from 1.5% to nearly 5% which has been a key part to Gold's recent rally. They've also been dumping US Treasuries and are currently at the lowest holding levels since 2009.

Their alignment also presents some pretty serious challenges in resolving the Ukraine crisis and any potential Taiwan related invasion.

The reason I bring up stories like this is to keep you aware of the big picture. Without the big picture, we lose perspective.

For example, here is an image showing the loss of purchasing power of our dollars since 1933...

We don't feel this daily. But if you zoom out it's sobering.

As you've likely heard before, these changes happen gradually...and then suddenly.

The reason we love gold and silver is because they are honest money in a world of dishonest manipulation.

As changes in the world accelerate, my hope is that you all use your communities, knowledge and minds to make the best decisions possible for you and your loved ones.

If I can help in any way, I'd love to.

As always, if you'd like to discuss any of these topics further, I'm always available. Feel free to give me a call anytime.

Tags:

May 23, 2024 12:00:00 AM

Comments