Gold and Silver Slammed

The past few market days have been brutal, especially for those who rely strictly on the price of a stock with no underlying intrinsic value.

Gold took a 2.5% dip yesterday and silver dropped 4%.

The big tech stocks that have been propping up the stock market for the last year+ got hammered due to some weak earnings reports. The S&P 500 fell by 2.3%, which was its worst day in a year.

The big selloff trickled into rallying assets like gold and silver so traders could save themselves and secure some profits.

Damion and I both agree, when opportunities like this are presented with gold and silver, you take advantage.

Nothing has changed from the fundamental reasons why people should own metals. Therefore, look at this as a major buying opportunity.

BRICS is creating a gold standard

It's becoming more clear that the BRICS nations are moving towards a gold standard.

This has been hinted at for the better part of the last year and, since then, lots has happened. The summary below and the linked article will clearly and simply lay out the plan and catch you up on everything you need to know about the BRICS gold standard progress.

I encourage everyone to read this as it's a simple and concise explanation of where we are with the BRICS movement.

The takeaway is to consider what this would mean for Western countries if they want to trade with BRICS, as Vince mentions in the article.

Hint: they will need to have more gold. Otherwise, they must make the necessary resources at home or with friendly nations. Which then leads to the question, which is less expensive and less dangerous to do?

This move would certainly challenge the dominance of the U.S. dollar. Remember, BRICS nations account for 30% of global GDP and have a population of 3.5 billion. The new plan includes:

- Adopting a gold standard

- Creating a unified payment system with advanced technologies

- Promoting central bank digital currencies (CBDCs)

If you want to understand the progress that BRICS has made in the last year, read the article below and you will well ahead of most. Link HERE.

Silver is cheap and primed for breakout

Ronnie Stoeferle, author of the In Gold We Trust report said last week "I've been writing, thinking, and investing in gold for nearly 20 years, and this is by far the quietest all-time high I've ever seen!"

It certainly feels that way.

Gold's recent surge to all-time highs has left silver even less talked about.

But history tells us silver won't stay down for long.

While gold is hitting all-time highs, silver is still 33% below its 2011 high.

When we say "silver is cheap", it's always relevant to gold. The gold-to-silver ratio is highly favoring silver right now.

During the brief silver surge in May, the ratio dropped to the mid 70's. Since then, it has climbed back up to 84. This is historically high and is a signal that silver is primed to outperform gold.

If you look at what happened with gold and silver from 2008-2011, you can really see the potential here.

The gap between them really narrowed - it went from 85:1 to just 33.1. During that time, gold prices shot up from $700 to $1,500. But silver was the real superstar, jumping from $9 to nearly $50!

We're taking the dip we see today as a buying opportunity as silver continues to prepare for liftoff.

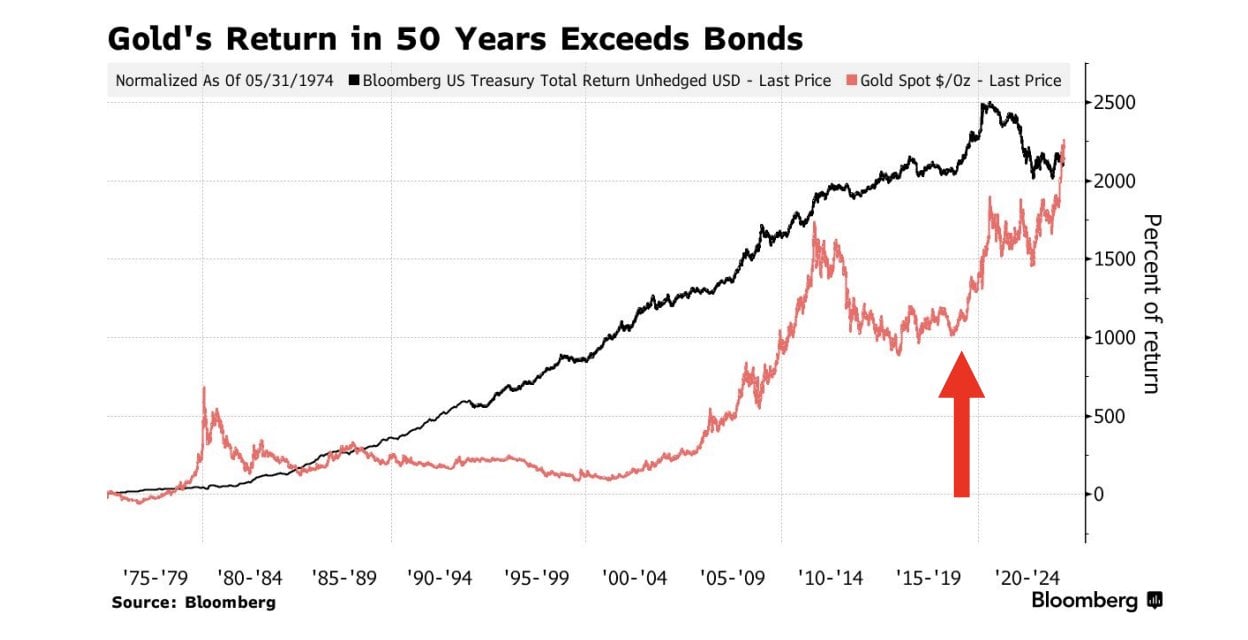

Lastly, the 60/40 portfolio has been a classic way to split your investments for decades. You put 60% into stocks and 40% into bonds. The mix is supposed to let you balance the "excitement" of stocks with the calm of bonds.

Gold rarely enters the conversation by most financial experts as being a replacement for bonds.

However, the chart below reveals that total return for gold over the last 50 years now exceeds that of bonds.

How many major financial institutions are talking about this? Answer: none.

Tags:

Jul 26, 2024 12:00:00 AM

Comments