Are Interest Rate Cuts Finally Here?

Jerome Powell testified before the US Senate Banking Committee this week to defend his policy decisions.

We got a hint that he’s beginning to see a shift in the relationship between inflation and unemployment, and he’s stuck with a difficult decision.

If he cuts interest rates too soon, the risk is a bounce in inflation.

Waiting too late and you're sending us spiraling into a recession with unemployment rocketing.

Inflation data is due later this week. Unemployment is already up. The markets seem to sense that we’ve reached a tipping point and could see cuts as soon as September.

Betting markets see two interest rate cuts this year as of now.

Of course, Powell stuck with his “we need more data to justify our decision” speech.

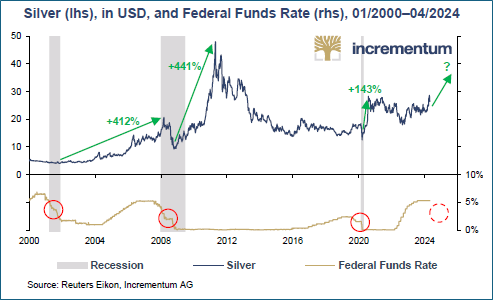

We’ve said this several times, but precious metals investors are set up to be beneficiaries of rate cuts whenever they do happen.

And as Peter Krauth points out, silver has returned 332% in the last three federal reserve rate cut cycles. That’s a good wave to ride.

Rate cuts and eventual money printing to help pay our parabolic debt is a recipe for intense currency debasement.

Investing in assets that directly benefit from the weakening of currencies is the most obvious decision we can make right now.

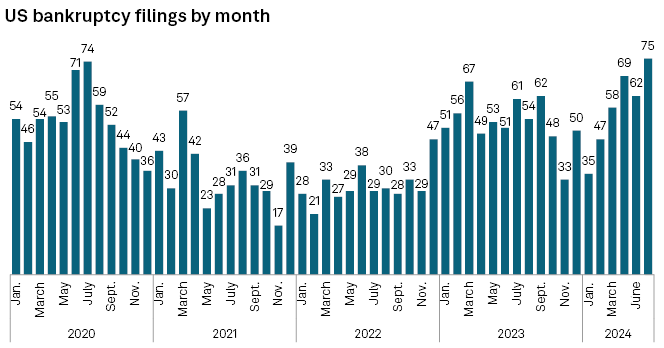

US Corporate Bankruptcies Are Spiking

There were 75 new corporate bankruptcy filings in June.

That’s the highest monthly total since 2020 and makes 346 total filings so far in 2024.

346 total in 6 months surpasses the half-year total in over a decade.

S&P Global conducted a study on this. It found that high interest rates, supply chain issues, and slowing spending were the primary causes of these filings.

All things we’ve been watching and anticipating that this high interest rate environment would soon impact.

There have been a total of 17 billion-dollar filings so far this year.

The "Consumer Discretionary Spending" sector is leading these bankruptcy filings. This is the most interesting point to me. Another sign that we may be well on our way to our first rate cuts as the economy slows.

Unemployment Has Entered The Picture

Unemployment data has entered into the clear picture of what the Fed is watching.

We've seen 3 months of rising unemployment. Powell said yesterday in his testimony that they can no longer only focus on inflation.

Unemployment data is known for being initially reported as higher and grabbing headlines and then later revised lower. This shaky data will make it harder for the Fed to judge when to act. The biggest risk is that it will cause them to wait too long to cut rates.

Along with June’s numbers that were just reported, we learned that April and May’s numbers were revised lower by 111,000 jobs.

The 3-month rolling average of job gains (not including June’s potential revision down the line), is 177,000. That's the lowest in 3 years.

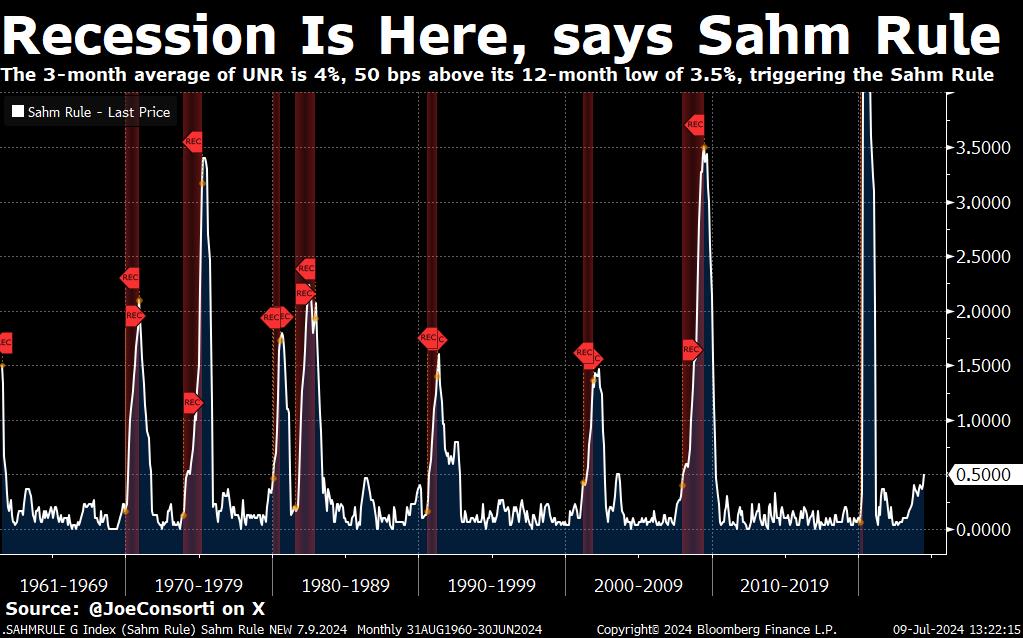

According to the Sahm Rule, we are ever so close to a recession using these unemployment figures.

The SAHM Rule is a simple, real-time recession indicator developed by economist Claudia Sahm. It uses changes in the unemployment rate to signal the onset of a recession. The SAHM Rule says a recession is likely if the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more from its low in the past 12 months.

Since the 70’s, this rule has accurately predicted economic downturns by ONLY being triggered during recessions, never outside of one.

We are only 7 bps away from triggering it.

Unemployment is about to become a major factor in policy decisions pretty quickly.

Don't miss this upcoming wave by sitting on the sidelines.

Tags:

Jul 11, 2024 12:00:00 AM

Comments